Fee Schedule

Deposit Method

Currency / Country

Fees

BTC MINNo Minimum

MAX (Day / Month)Unknown

0.00%

USDC MINNo Minimum

MAX (Day / Month)Unknown

USDUSA

0.00%Instant

Withdrawal Method

Currency / Country

Fees

USDC MIN1

MAX (Day / Month)n/a

USDCCA

10 USDC24h or sooner

BTC MIN150,000 satoshis

USDCCA

None2-3 business days

Overview

Overview

- Company Name: Ledn, Inc.

- Headquarters: 700-350 Bay Street, Toronto, Ontario, Canada M5H 2S6

- Official Website: ledn.io

- Established in August, 2018

If you are searching for a simple, secure platform where you can deposit BTC and USDC to earn interest, Ledn is worth a look.

In this review, we are going to give you the full rundown on everything Ledn has to offer. Our main focus will be on the program to save and earn, but we will also discuss Ledn’s other services as well.

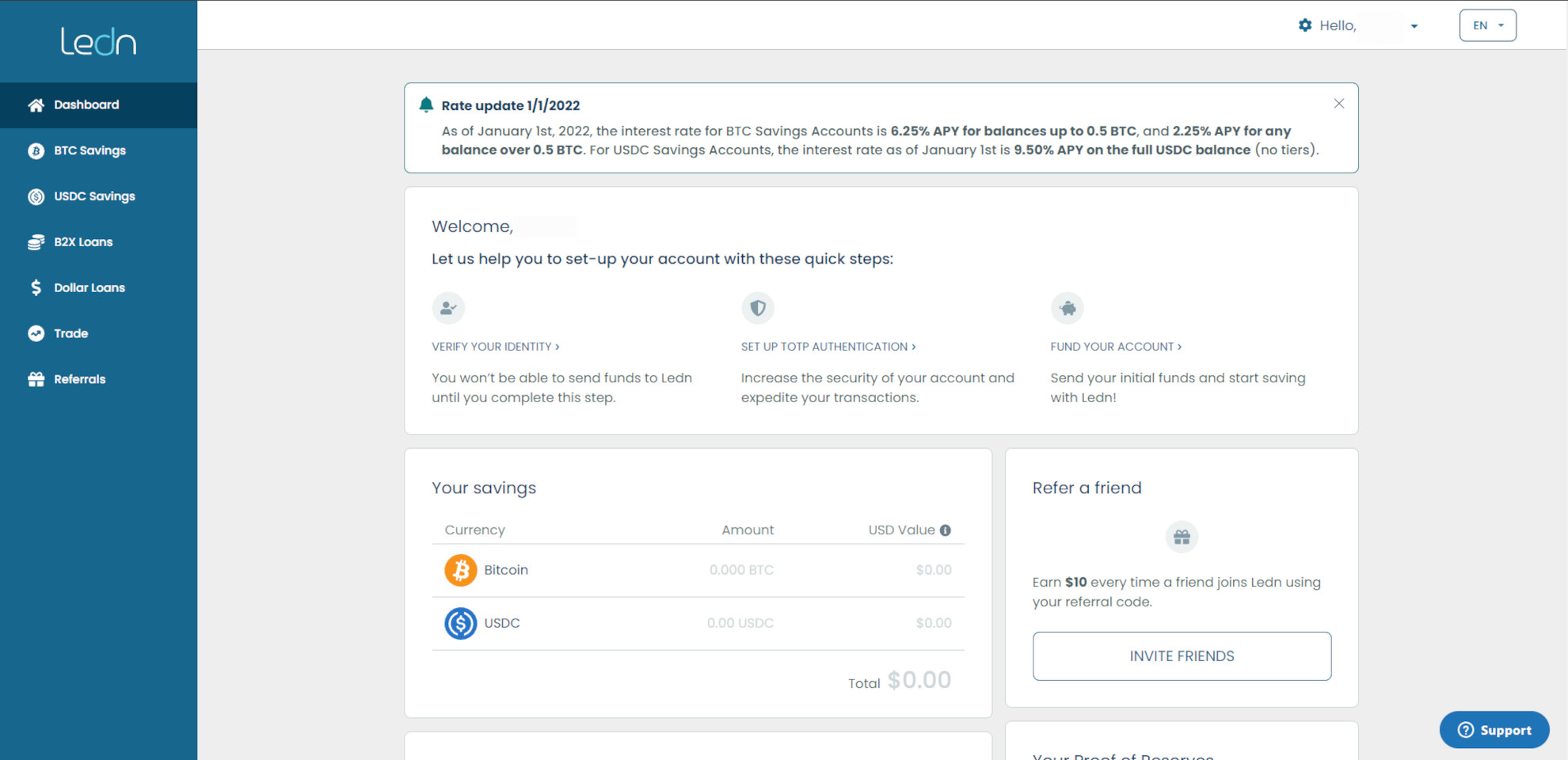

Immediately upon landing you’re asked to register with some very basic information.

What is Ledn?

Ledn is a platform that offers crypto savings accounts where you can earn interest on your holdings and or take a loan using bitcoin as collateral. The platform is run by a company called Ledn, Inc., which was founded in 2018. Ledn also lets you borrow crypto and trade BTC and USDC seamlessly. Plus, there is a special program for doubling your bitcoin called B2X.

Who Should Use Ledn?

Anyone who is looking to earn interest on crypto or borrow money against your crypto should consider Ledn.

What we like specifically about Ledn is that they work with Genesis, whom is the lender of last resort in the bitcoin world. Genesis requires you to have a minimum of 100 BTC to lend directly through their platform. Needless to say, the average user has nowhere near this amount of crypto.

Ledn has no minimum balance requirement for its savings accounts. Anyone can earn interest by storing bitcoin or USDC with Ledn. As Ledn then lends funds primarily to Genesis, it is similar as you loaning through Genesis once removed. (source this prohashing article)

Ledn Background

In 2018, Adam Reeds & Mauricio Di Bartolomeo co-founded Ledn. Since its inception, this company has grown to offer its services in more than a hundred countries.

Ledn writes, “Ledn is the first-ever digital asset lending platform to undergo a formal proof-of-reserves attestation, where an independent public accountant regularly attests that the company is properly accounting for client assets.”

Does Ledn Appear Legit? – Is Ledn Legit, Licensed, Regulated and Legal?

Ledn says, “Ledn Inc. is incorporated under the Federal Laws of Canada. As such, Ledn is held to the highest standards of consumer protection and data privacy. Ledn is not an ICO.”

In its trading terms, the company states, “We are not regulated as a bank or other depository institution. Your Savings Account is not a deposit account or a bank account. Digital Assets held in your Savings Account are not covered by insurance against losses or subject to FDIC or SIPC protections or the protections of any comparable organization anywhere in the world.”

Going by our research, Ledn is working toward registering as an investment dealer with the Ontario Securities Commission, but has not yet received approval.

Co-founder Mauricio Di Bartolomeo informed The Globe and Mail, “We filed our registration and disclosed our business model to the OSC in March, but we are still waiting to complete the regulatory process. We’re not sure yet how the OSC plans to designate us.”

The company is, however, a registered money service business in the US and Canada with FINCEN and FINTRAC respectively.

So, Ledn is still working toward becoming regulated, but appears to be on its way. The hold-up has less to do with the company itself and more to do with OSC.

Meanwhile, Genesis is regulated with FINRA and the SEC as a securities broker-dealer. So, strictly from a regulatory standpoint, working with Genesis may be less risky than depositing your funds with Ledn. But because of the high minimums Genesis sets, that is not an option for most crypto users.

Given that reality, we feel reasonably satisfied with the current situation concerning Ledn’s regulatory status. The company is forthright and transparent about its status, and is taking the steps necessary to be compliant. Hopefully soon, OSC will get a move on and decide on the company’s designation.

Screenshots

Ledn Security – Is Your Crypto and Data Protected?

When it comes to safety, regulation is not the only thing you need to concern yourself when depositing your crypto with a company. You also need to check into security. How does Ledn’s measure up?

Describing its encryption protocols, Ledn writes, “Our site uses HTTPS, passwords and sensitive information is encrypted using AES-256, and all our processes are regulated by strict internal security policies. Additionally, login and specific actions on the platform require 2FA for peace of mind.”

Another thing that is reassuring is that this company promises to never sell client data. Instead of keeping your information on local servers, Ledn instead keeps those records in secured private networks.

If, at any time, you want Ledn to delete your information, all you have to do is reach out to support.

Does Ledn Have a Good Reputation?

We researched to find out what customers have been saying about their experiences with Ledn. Based on our findings, this company provides a great experience. Their transparency, their solid customer support, and the impressive simplicity and ease-of-use of their platform are what users like. The interest rates are also nothing to complain about.

Speaking of customer service, we did go ahead and test that out for ourselves. We sent over a question through the messaging system and checked our email an hour later. The response was there waiting for us, and provided us with all the detail we needed.

After that basic info and verifying your phone number you can start to really look around the site.

What Services Does Ledn Offer?

Now that you know the basics concerning Ledn’s background, regulatory status and security, we can press on to offering details on the company’s services.

In this review, we are going to focus on Ledn’s program to save and earn, but we will also briefly go over the other services as well.

- Save and Earn Interest

Ledn offers a simple, streamlined service for crypto savings accounts. Because there are no minimums, you can get started earning interest even if you have just a small amount of crypto. But if you have a large amount, that is fine too. Ledn is suitable for all account sizes.

When you deposit your funds, Ledn will generally lend them out to Genesis, which will then lend them out to borrowers.

Sometimes, however, your funds will be in storage with BitGo, a reputable and secure custodian.

One thing that is exciting about Ledn is that you can earn really competitive interest. If you are depositing bitcoin with the company, you can qualify for up to 6.25% APY. If you are depositing USDC, then you can qualify for up to 9.50% APY.

Ledn is transparent about how it is able to offer these high interest rates. There are two main means:

- As we discussed, Ledn loans to Genesis.

- Ledn also offers bitcoin-backed loans which it uses to offer additional interest if you deposit USDC.

What are the Benefits of Saving and Earning Interest with Ledn?

- You can earn impressive interest through the savings account program offered by Ledn.

- Getting started with a Ledn savings account is easy and straightforward, even for a crypto novice.

- Deposits are rapid; you can usually expect your funds to arrive within 10 minutes or so for BTC, and around 4 minutes or so for USDC.

- Withdrawals are quick and flexible; you can request one any day of the week at any hour. Most of the time, your request will be processed inside a single business day.

- The 10 USDC withdrawal fee is not too bad if you plan ahead and do not make too many requests. As you can withdraw up to 1,000,000 USDC or 100 BTC in any given one-week period, most users do not have to worry about hitting a ceiling.

- With no minimum balance to earn interest, anyone can take advantage of a savings account from Ledn, including users who would be turned away by Genesis.

- Ledn’s custodian BitGo is insured.

Are There Any Drawbacks?

At this time, Ledn only accepts BTC and USDC. If you want to deposit any other type of crypto into a savings account, you will either need to convert it into either of these asset types or take your business somewhere else.

Borrow

While Ledn’s savings/lending program is what attracted us, the platform also offers some other great services, like bitcoin-backed dollar loans.

What are the Benefits of Borrowing with Ledn?

- You can fill out the application for a loan within just a couple of minutes. Make sure you have your proof of identity and address ready to go.

- Ledn offers full flexibility with respect to when you withdraw the money you borrow and when you pay it back. You will never be charged a prepayment penalty.

- You can quickly and easily check how much BTC collateral is required using the site’s handy calculator for any given loan amount in USD or USDC.

Are There Any Drawbacks?

You will pay a hefty amount of interest on a Ledn loan, but this is par the course with these types of fast crypto-backed loans.

Trade

Ledn does support limited trading through its platform as well. If you want to exchange BTC for USDC or vice versa, the platform makes it fast and easy.

What are the Benefits of Trading with Ledn?

- Like the other services Ledn offers, the trading interface is intuitive and straightforward, making it easy to use for even for those who are relatively inexperienced.

- There are zero fees for trading.

- You can earn interest right away when using Ledn to trade, thanks to the fact that your funds will be in your savings account. So, say you exchange BTC for USDC. You should start earning the higher APY associated with USDC instantly.

- Trading limits range up to $2M USD per position, which should be more than adequate for the majority of users.

Are There Any Drawbacks?

Again, you can only exchange between BTC and USDC. So, this platform’s applications for trading are quite limited.

B2X

A specialty service available through Ledn is B2X, which offers you a “quick and simple way to double your bitcoin balance.”

How does this process work? Ledn describes it best: “Through the B2X service, users access a dollar loan and purchase an amount of bitcoin equal to their initial holdings. By doing so, the user holds twice as much bitcoin, with a bitcoin-backed loan for the dollar amount used to purchase the bitcoin.”

What are the Benefits of B2X with Ledn?

- If you already have funds in a savings account with Ledn, you can apply for B2X in under a minute.

- It is up to you when you repay your loan within a 12-month period. Paying your loan off early reduces the total interest you will owe, and does not result in any prepayment penalty.

- Ledn is the only company we are aware of that is offering a product like this at this time. It is an innovative option for doubling your BTC holdings.

Are There Any Drawbacks?

You do have to take out a loan, pay it back, and pay interest, so, it comes at a cost. But if you just want to hold more BTC and feel confident that the price of BTC will continue to rise, it could pay for itself and deliver a profit.

Can Anyone Use Ledn?

Unfortunately, no, thank your local lawmakers for that.

When making a deposit with bitcoin you will see that there is a little list of states that are not able to use this service:

- New Jersey

- New York

- Connecticut

- Hawaii

- Washington

- Washington D.C.

- Wyoming

And when trying to deposit some USDC you’ll see that same list as above but adding Texas to the list as well as the following countries:

- North Korea

- Iran

- Libya

- Syria

Advantages and Drawbacks of Ledn

Having had a chance to go over the pros and cons for the individual services that Ledn offers, we can review advantages and drawbacks for the platform as a whole.

Pros of Ledn:

Ledn’s background checks out, and the company is cooperative with regulators. So even though Ledn is not yet regulated, we feel comfortable saying that this is a trustworthy and reliable platform.

On Ledn, lending, borrowing, and trading are simple. This is one of the biggest selling points for the platform, as others are often needlessly complicated and inaccessible to novices. There is no need to feel intimidated by Ledn. You will find it refreshingly easy to find your way around and understand how all their crypto services work.

Solid security and privacy protocols protect your funds and data. You can feel confident that your risk is low (aside from the general risk that is always associated with holding crypto).

You can earn a high interest rate with Ledn. That gives you a chance to quickly grow your crypto savings.

The platform’s flexibility makes it an ideal choice for a wide range of investors. Unlike Genesis, Ledn has no problem working with customers who have small account sizes.

Cons of Ledn:

You can only receive customer support 24/5, not 24/7. There is also no live chat, as far as we can tell. When you use the chat window, it just sends an offline message, and you have to await your response via email.

It would be nice if Ledn were fully regulated, but as of the time of this writing, the company is working on that, so this is not a major drawback.

There are no check summed Ethereum addresses. While this is not the end of the world, there is not much reason why it should not already be a feature here.

It takes minutes to understand how Ledn works. If you have been searching for a straightforward platform without unwanted bells, whistles and fine print, you have found it.

In short, Ledn is for everyone. No matter who you are, you will appreciate the flexibility, elegance, and reliability of this crypto platform.

Bonuses

Get $10 in Bonus With Special Link

Open an account with this link to Ledn.io and then deposit and hold a minimum of 75 USDC or .0015 BTC in a Ledn Savings Account for 15 days or longer. You must make your initial deposit within 30 days of opening an account.

Pros & Cons

Earn high interest rates by lending.

Borrow or trade quickly and easily.

Enjoy a simple interface.

There is no minimum balance requirement.

No live chat.

No check summed Ethereum addresses.

Not regulated yet.

Verification

Types of Verification

Government ID, Selfie, Email, Phone

Verification Process

First off, you’ll enter some very basic information. You’ll be entering your:

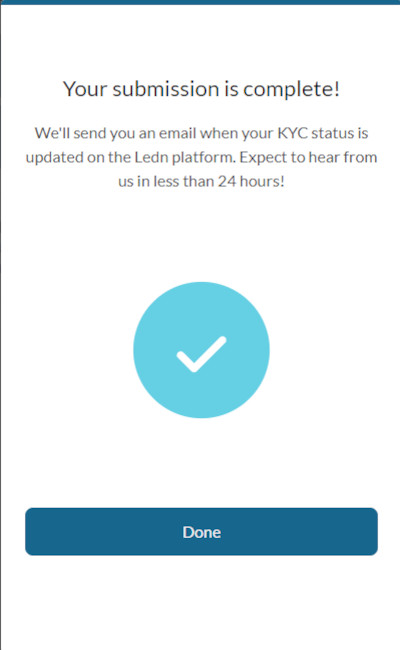

After entering all of your info, Ledn says to expect them within 24 hours.

- First name

- Last name

- email address

- Phone number

Once you verify your email and phone number you’ll be ready to finish going through the Know Your Customer information. Here you’ll be entering your:

- Date of Birth

- Street Address

- City

- Country

- State

- Zip Code

- Occupation Industry

- Occupation

*Note – We’re American. The list above will change depending on where you live!

And Ledn will also ask you these three questions while you’re on that page:

- What is the source of your BTC or USDC?

- What is the intended use of these proceeds?

- Are you, or a close relative, or a close associate, a Domestic/Foreign Politically Exposed Person or Head of an International Organization?

Withdrawal Process

Frequently Asked Questions

Is Ledn safe?

Yes, we feel confident stating that Ledn is safe. Even though the company is not yet fully regulated, Ledn has kicked off the process with the Ontario Securities Commission.Moreover, Ledn has had several years to establish itself, and over those years, has built a strong reputation for reliability and transparency.

What are the top reasons to use Ledn?

There are plenty of reasons to recommend Ledn, but here is our top reason:You do not need 100 BTC to open an account and start earning interest here, even though Genesis will be indirectly loaning out your funds. There is no minimum balance requirement, so anybody can earn interest on Ledn.

Ledn may not be like other exchanges in the sense that this isn’t an “exchange” at all since you cannot go here and buy any BTC or USDC which are the only types of crypto that Ledn deals with. Instead, this is a site to keep and save these cryptos with some pretty decent interest rates.

Let’s face it. You can keep your BTC in a Trezor or something equally safe but once it’s there you’re not collecting any interest on it at all!

Ledn may just be the answer for someone that’s looking to obtain one of these cryptos and just let it sit for a year or two or more and collect some more for themselves.

Also, Ledn seems to be offering some pretty decent loans to people that have the collateral to carry it out a bit.

It would be nice if Ledn got the regulation they’re looking for from the OSC, but at the same time we haven’t heard anything negative yet and they, (Ledn) have been very honest, open, and forthcoming about their current standings, being very transparent and not looking as though they’re trying to hide anything.