Fee Schedule

Deposit Method

Currency / Country

Fees

Bank Wire MIN10

Varies

Crypto

USDUSA

Network Fees OnlyInstant

Withdrawal Method

Currency / Country

Fees

Crypto

USDUSA

1 free per monthInstant

Overview

- Company Name: BlockFi, Inc.

- Headquarters: 86 Chambers Street Suite 205 New York, NY 10007 United States

- Official Website: https://www.blockfi.com/

- Established in August, 2017

Are you in search of a service that offers an alternative to traditional banking? If so, you might be intrigued by BlockFi.

This service offers a number of cryptocurrency products. You can earn interest, take out a loan, trade cryptos, or even get a credit card through BlockFi.

What drew to me to BlockFi is the fact that they do not need you to invest in utility tokens to participate (or get the best benefits).

That means that every user is eligible for the best that the site has to offer.

In this detailed review, we will go over what you need to know about BlockFi. We will discuss the background of the company along with in-depth information about each of its services.

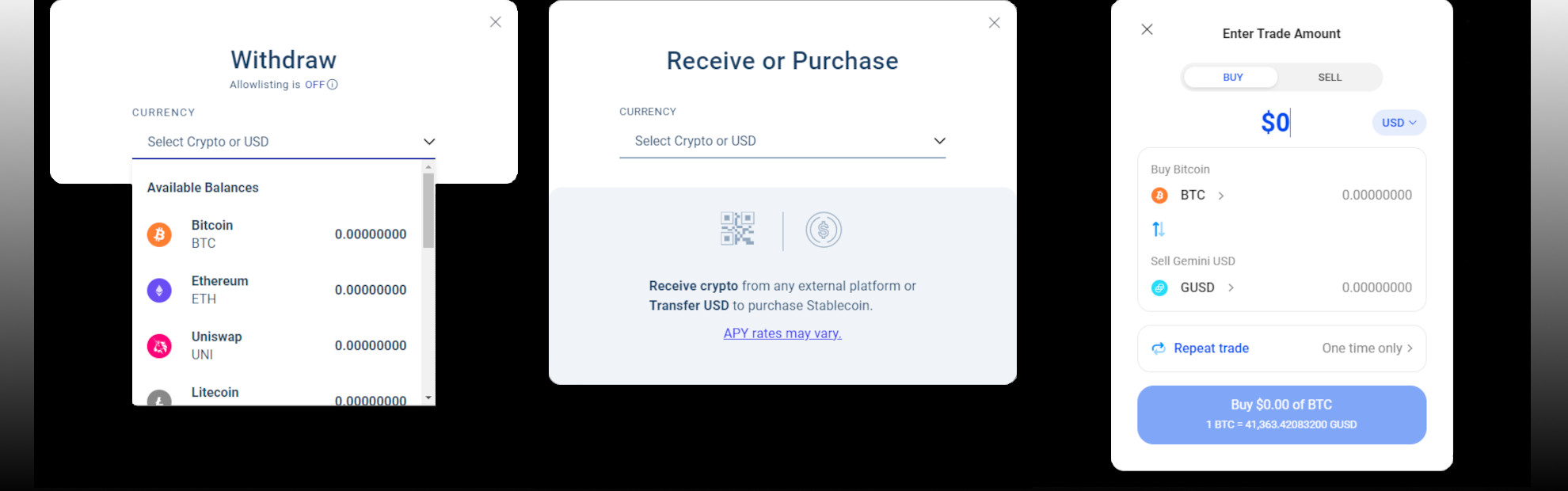

Screenshots

What is BlockFi?

BlockFi is a platform that lets you borrow or earn interest on crypto. A few of these have cropped up in recent years. Most of them rely on participants investing in utility tokens (Celsius being one example). BlockFi does not operate that way.

- Borrow against your crypto

- Earn interest on crypto *no longer available to new USA accounts

The company was founded by Zac Prince and Flori Marquez in 2017, and receives institutional backing from Galaxy Digital, Fidelity, Valar Ventures, SoFi, Akuna Capital, and Coinbase Ventures. It has offices in New York, New Jersey, Argentina and Poland.

Describing its purpose, the company writes, “BlockFi’s vision is to bridge the worlds of traditional finance and blockchain technology to bring financial empowerment to clients on a global scale.”

These are the values it lists on its site:

- Pragmatic pioneering

- Clients, not customers

- Individual effort, collective success

- Transparency Builds Trust (#TBT)

In this guide, we are going to focus mainly on the products that BlockFi offers to regular individuals, but the company also offers institutions services, so that may interest you as well.

Who Should Use BlockFi?

Asking yourself, “Should I use BlockFi?” BlockFi may be right for you if:

- You are looking for a convenient platform that offers a wide range of services, including trading, earning, borrowing and more.

- You want to reduce your reliance on traditional banking for basic financial services.

- You do not want to purchase utility tokens just to qualify for competitive interest rates.

- You need to borrow money fast with an affordable APR, no hard credit check, and easy qualification.

- You want to earn interest on your crypto by loaning it through a trustworthy company.

- You would like to earn crypto passively while you use a fee-free credit card.

BlockFi Background

Does BlockFi Appear Legit? – Is BlockFi Legit, Licensed, Regulated and Legal?

Yes, BlockFi is legit. In fact, you might be familiar with the company’s primary custodian, Gemini Trust Company, LLC.

Gemini is based in New York, and is regulated by the New York State Department of Financial Services.

Moreover, it reassures me that BlockFi is actually a US-based crypto exchange. There are not a whole lot of those out there.

BlockFi writes, “BlockFi is one of the few retail-focused crypto-interest-earning platforms that’s also domiciled and regulated in the US, institutionally backed and doesn’t have a utility token. That’s important–we play by the rules, to the benefit of our company and our clients.”

The company actually holds quite a few licenses, so I am not going to type them all out here. But you can view them yourself on this page.

Now, as of the time of this writing, I should note that multiple regulators have been going after BlockFi (indeed, this just happened within the past few days—I am writing this in July, 2021).

But this issue seems less to do with fairness and transparency and more to do with a matter of syntax and semantics regarding BlockFi interest accounts.

Basically, even though these accounts act much like deposit accounts, states are viewing them as investment products.

So, this is not really a matter of “legitimacy”, but it does mean that the BlockFi Interest Account (BIA) might not be available in every state in the future. So, that is just something to keep an eye on.

About BlockFi Security

BlockFi takes the security of customer funds and information seriously. Here are some of the steps the company takes to protect you:

- Modern ciphers, supported protocols, and multi-factor authentication all are used to help encrypt your data.

- All devices the company manages are protected against remote and local attacks. Security for these devices meets or exceeds standards like CIS, ISO, and NIST.

- he company trains every employee in cybersecurity. Before hiring, the company engages in extensive background checks.

You can read about these and other methods BlockFi uses to protect its customers in detail here.

What about the data breach that took place in May 2020? You can read the company’s own incident report at this page.

The company took swift action to close the security loopholes that led to the breach, and even hired Adam Healy, a security specialist who worked with the US Intelligence Community and Department of Defense, to serve as Chief Security Officer.

What Services Does BlockFi Offer?

Now that you have some background on BlockFi, let’s take a close look at what this company is offering in terms of crypto products and services.

- BlockFi Interest Account

- Trading Account

- Crypto-Based Loans

- Credit Card

We will start with the BlockFi Interest Account.

The BIAs have not been registered under the Securities Act of 1933 and may not be offered or sold in the United States, to U.S. persons, for the account or benefit of a U.S. person or in any jurisdiction in which such offer would be prohibited.

BlockFi Interest Account

If you are holding cryptocurrency, you might as well be earning a solid interest rate. You can deposit your crypto into an account with BlockFi to start earning right away.

BlockFi pays out interest once a month.

The steps to getting started with a BlockFi Interest Account (BIA) are super easy:

- Open a new account on the platform.

- Deposit your crypto, stablecoin, or USD.

- Wait for your first interest payment.

The interest rates on BIAs are tiered, but they do not depend on holding any sort of platform utility tokens. Interest rates start out at around 0.25%, and range as high as 8.5%.

What determines your interest rate with BlockFi?

Both the specific type of crypto you are depositing as well as the amount in your interest account will determine the rate you receive. Here is the full table of rates **these change as market forces change, always find the latest rates on their official website:

| Currency | Amount** | APY |

|---|---|---|

| BTC (Tier 1) | 0-0.25 BTC | 4% |

| BTC (Tier 2) | 0.025-5 | 1.5% |

| BTD (Tier 3) | 5 BTC | 0.25% |

| ETH (Tier 1) | 0-5 ETH | 4% |

| ETH (Tier 2) | 5-50 ETH | 1.5% |

| ETH (Tier 3) | >50 ETH | 0.25% |

| LTC (Tier 1) | 0-100 LTC | 4.5% |

| LTC (Tier 2) | >100 LTC | 2% |

| LINK (Tier 1) | 0-750 LINK | 3% |

| LINK (Tier 2) | >750 LINK | 0.5% |

| USDC (Tier 1) | 0-50,000 USDC | 7.5% |

| USDC (Tier 2) | >50,000 USDC | 5% |

| GUSD (Tier 1) | 0-50,000 GUSD | 7.5% |

| GUSD (Tier 2) | >50,000 GUSD | 5% |

| PAX (Tier 1) | 0-50,000 PAX | 7.5% |

| PAX (Tier 2) | >50,000 PAX | 5% |

| PAXG (Tier 1) | 0-5 PAXG | 2% |

| PAXG (Tier 2) | >5 PAXG | 0.5% |

| USDT (Tier 1) | 0-50,000 USDT | 7.5% |

| USDT (Tier 2) | >50,000 USDT | 5% |

| BUSD (Tier 1) | 0-50,000 BUSD | 7.5% |

| BUSD (Tier 2) | >50,000 BUSD | 5% |

| DAI (Tier 1) | 0-50,000 DAI | 8.5%**** |

| DAI (Tier 2) | >50,000 DAI | 6%**** |

| UNI (Tier 1) | 0-750 | 3.75%**** |

| UNI (Tier 2) | >750 | 1.5%**** |

| BAT (Tier 1) | 0-25,000 | 3.65%**** |

| BAT (Tier 2) | >25,000 | 1.4%**** |

On this page, you can find an explanation of how tiered interest works on the platform. As it is a bit hard to explain, we will just share the examples that are on that page:

- If you hold 1 BTC: 0.25 BTC would earn 4% APY, and the remaining 0.75 BTC would earn 1.5% APY.

- If you hold 25 BTC: 0.25 BTC would earn 4% APY, 4.75 BTC would earn 1.5% APY, and the remaining 20 BTC would earn 0.25% APY.

- If you hold 100 ETH: 5 ETH would earn 4% APY, 45 ETH would earn 1.5%, and the remaining 50 ETH would earn 0.25% APY.

What are the Benefits of the BlockFi Interest Account?

Every month, not only do you get paid interest, but BlockFi runs a new calculation for your interest based on the current amount in your account. As that includes the interest you earned from the previous month, your interest compounds over time.

It is fast and easy to get started. In fact, you can open your account in under two minutes. Your earnings will start that day.

You get to decide what type of crypto your interest payments are deposited as.

You can set up two-factor authentication for your interest account if you wish.

Managing your account is easy no matter what device you are using. The BlockFi app is compatible with pretty much anything you can name.

You do not need to invest in utility tokens in order to get the best interest rates. Investing in such tokens can be prohibitive on some platforms.

Withdrawal requests are usually processed within 1-2 business days.

Are There Any Drawbacks?

Although interest rates are competitive, the tiered system does mean that the bulk of your funds earn lower interest rates. For example, if you are holding 100 ETH, it is not as if you can earn 4% APY on all of it. Most of it will be earning 0.25% or 1.5%. Calculating your actual interest rate payments may prove to be confusing, especially when you are new to the system.

There are a number of assets that are supported, but that number is not as vast as it is on some other platforms offering similar accounts.

You can only make limited withdrawals without paying fees. BlockFi explains, “Currently we offer one free crypto withdrawal and one free stablecoin withdrawal per calendar month. Any addition withdrawal after that may be assessed a withdrawal fee.”

Withdrawals can be slow for customers taking out small amounts. The site says, “Although there is no minimum balance required to earn interest, accounts are still subject to Gemini’s withdrawal minimums: 0.003 BTC and 0.056 ETH. Withdrawals for balances smaller than these amounts may take up to 30 days to process.”

You also should note that interest rates on this platform fluctuate. That is not necessarily a good thing or a bad thing per se.

Trading Account

Another product that BlockFi offers is a trading account.

Spread fees may be as high as 1%. There are zero transaction fees to pay when you trade.

What are the Benefits of the BlockFi Trading Account?

Trade execution on the platform is virtually instant.

You earn interest on the cryptocurrencies that are in your account.

If you want, you can set up recurring trades that will execute automatically. You can set these to take place every day, once a week, or on the 1st or 15th each month.

The fact that there are no trading fees is great news in particular for those who place a lot of trades.

Are There Any Drawbacks?

Trading on this website is fast and affordable. On the whole, I am happy with it, and cannot really think of any significant drawbacks to report.

Crypto-Based Loans

Looking for a flexible way to borrow money fast? BlockFi makes it a breeze to borrow through the platform.

It is important to understand how crypto borrowing on BlockFi works.

As is typical with crypto loan services, what BlockFi offers are secured loans.

The collateral the loans are secured against is the money in your account.

What are the Benefits of BlockFi Loans?

Interest rates are as low as 4.5% APR, making this an affordable way to get the funds you need.

You can receive your funds on the same business day you apply. You just need to make sure your collateral is in your account. In some cases, you could have your loan in just 90 minutes. So, if you are in a rush, this is a good way to get the cash you need fast.

You do not require perfect credit. Since you secure your loan with collateral, this is a flexible, easy-qualification loan.

Are There Any Drawbacks?

The minimum amount you can borrow is $10,000. For some customers, this may be a little high.

The collateral requirements are quite high. For example, if I want to borrow $1,000 USD, I need to have 0.05 BTC in collateral.

So, this is a situation where in order to borrow money, you have to already have money.

That being said, I cannot list this really as a “specific” drawback, because it is par the course right now with these types of crypto loans. It is the same thing you would encounter pretty much anywhere else at this point.

Credit Card

Like other companies in the crypto banking alternatives sector, BlockFi is getting into offering credit cards.

The card is not yet available, but you can put your name on the waitlist immediately.

As the company points out, a BTC credit card like this one is ideal regardless of whether you currently invest in crypto or not.

In fact, it is an easy way to dive into crypto if you do not want to worry about purchasing it or mining it.

Just by making your regular purchases, you will start accumulating crypto funds.

What are the Benefits of the BlockFi Credit Card?

For every purchase you make, you can earn 1.5% back in bitcoin. There is no limitation on this reward. The more you spend, the more you will earn.

Big spender? If you spend more than $50,000 in a year, you can earn 2% back on additional purchases.

A 3.5% introductory offer gives you some extra crypto bang for your buck for the first three months.

There are no foreign transaction fees on this credit card, making it a great choice if you make a lot of purchases from companies located overseas.

This credit card does not have an annual fee. So, it helps you keep your money in your pocket.

You can apply without a hard credit check, protecting your score.

Are There Any Drawbacks?

Once again, it is hard to come up with any drawbacks. With its fee-free structure and its generous cash-back, it is an easy way to earn BTC.

Does BlockFi Have a Good Reputation?

We have seen nothing but positive feedback from BlockFi users. Customers like the company’s strong focus on security. They also appreciate that they loan to institutional borrowers, and only after conducting through assessments.

As far as complaints go, most of the ones we see revolve around withdrawals. Sometimes, you might be asked to verify your identity again. And after you get your withdrawal address on the whitelist, you have to wait a week before you can use it.

One could only really call this a disadvantage as far as convenience goes. Plus, it is one that you can mitigate by planning ahead. Since it is all in the name of security, it isn’t really a negative at all.

Advantages and Drawbacks of BlockFi

We have discussed pros and cons for various BlockFi products, but let’s now go over the general pros and cons for the platform overall.

Pros of BlockFi:

This is an all-in-one website offering all the crypto services and products you need. It is convenient to be able to find everything in one place.

BlockFi is very serious about security. This company goes above and beyond to make sure that your data and funds stay out of the wrong hands.

Gemini is the custodian, so your funds are safe. This is definitely one of the top advantages that BlockFi has to offer. Gemini is a solid name, and knowing that they are going to be the ones in charge of your funds goes a long way to enhancing peace of mind.

No utility tokens are necessary. If similar platforms turned you off by requiring you to invest in utility tokens to take advantage of some of their products, you will be glad to know that there is no requirement to invest in them at BlockFi. Indeed, since that also removes the potential requirement to be an accredited investor, it means that your financial means (or lack thereof) will not be a barrier to you in enjoying all that BlockFi has to offer.

Fees are very limited. There are no foreign transaction or annual fees for the BlockFi credit card, and no trading transaction fees. BlockFi helps you to keep your money in your account.

BlockFi is licensed and safe. You can rest assured that the company you are dealing with is conforming to the legal requirements to maintain its licenses. Plus, since it is licensed and regulated in the US, BlockFi is subject to more stringent laws than the regulations that govern some competing platforms based in other countries.

The company makes it easy to get started with its products. You can get started in a matter of minutes. You do need to verify your identity right away after you confirm your email address and before you can access any products, however, so be ready to do that.

Cons of BlockFi:

Interest rates for earnings are not the highest. Interest rates on this platform range as high as 8.5%. That is quite competitive, but it is not the highest interest rate you are going to find out there. In fact, Celsius pays up to 17.78% APY.

The tiered structure for earnings is not spectacular. If you are loaning out a large amount of crypto, the majority of it will not earn the top interest rates.

The crypto selection could be larger. Some competing platforms offer more in this regard.

Withdrawals can be a bit restrictive. You need to plan out your withdrawals carefully so that you do not incur any unnecessary fees. And in some cases, withdrawals may be a bit slow.

Should Someone use BlockFi or Celsius?

Wondering how BlockFi and Celsius compare? Here are some of the key similarities and differences to be aware of:

- BlockFi and Celsius are similar platforms that offer some of the same basic services.

- Celsius offers higher interest rates if you want to loan out your cryptocurrencies than BlockFi does.

- You must be an accredited investor in order to invest in the utility tokens on the Celsius platform.

- Both Celsius and BlockFi are licensed, regulated, secure, and safe.

On BlockFi, these include: earning interest, taking out crypto loans, trading, and credit cards. On Celsius, they include making or accepting crypto payments, earning interest, taking out crypto loans, and credit cards.

That being said, Celsius requires you to invest in its utility tokens for the most competitive rates. BlockFi does not.

There is no such requirement to benefit from any aspect of BlockFi’s products or services. Becoming an accredited investor requires significant financial means.

So, which of these two platforms you should use depends on the exact products you need as well as what you are looking for in terms of interest rates and participation in utility token investments.

In fact, many people sign up for accounts on both platforms in order to take full advantage of everything they collectively offer. It is also a good way to spread some of your risk around.

Final BlockFi Thoughts

We have just discussed BlockFi and its products and services in-depth. You have had a chance to discover the pros and cons of each, and to learn a little bit about how BlockFi compares with Celsius.

Ready to throw off the shackles of traditional banking? If you are looking for easy qualification loans, a fee-free credit card with impressive crypto cash-back, or the chance to earn on your cryptocurrencies, BlockFi is the full-service banking alternative and crypto trading platform you are looking for. Click the link below to sign up now.

Pros & Cons

Strict Security Protocols

Utility Tokens Not Required

Limited Fees

Low Interest Rates

Crypto Selection on the Low Side

Withdrawal Process

Frequently Asked Questions

Is BlockFi legitimate?

Yes, the company is licensed and regulated, based in the US, and uses Gemini Trust Company, LLC as its primary custodian. Find out more in our detailed section on regulation in our full review above.

Is BlockFi worth it?

If you are looking for the products that BlockFi offers (a credit card, a trading platform, loans, and/or earning opportunities), then absolutely. The platform is safe, offers competitive rates and fees, and is easy to use.