How to Research to Choose Cryptos for Investing

Did you know there are more than 22,932 cryptocurrencies in existence? That is an investor’s dream as well as their nightmare. With so many cryptos out there, there is ample opportunity for profit!

This isn’t even remotely close to the amount of cryptos out on the market!

With so many cryptos, most of us can only name a couple dozen at most. The reality is that the vast majority of this astonishing number of cryptos will remain obscure or fail.

With so many different coins and more being created every day, how do you find promising investment opportunities? This post will walk you through a checklist of everything you should look into before you decide to buy a coin.

For the sake of this guide, we are going to assume your interest is to HODL (Hold On for Dear Life) your coins over the long term, rather than day trading short-term positions.

So, we are going to be focusing on how you can assess the value and potential of a coin over the months and years ahead, rather than looking at price action (though we will consider that too).

Where Can You Research Cryptos?

Research never sounds like a whole bunch of fun, but you’re really going to want to do it anyway!

Before we dive in with the checklist, let’s talk about where you can research cryptos in which to invest.

- Exchanges:

- News sites:

- Social media:

- Data aggregators:

- White papers:

- Tools:

The exchanges where you have accounts offer a good starting point, since you can just take a look at what they are listing. In fact, many even tell you what they have recently added.

Keep an eye on news sites, including those for general news as well as crypto-specific news.

Sites and apps like Discord, Facebook and Twitter can all point you toward interesting crypto projects that might be worth investing in.

These tools give you fast information about different coins and their volume, prices, market capacity and so forth. They provide an easy way for you to run comparisons between coins.

These are in-depth resources that are published by the creators of a cryptocurrency to explain their tokenomics, governance and more. You should read the white paper for any coin you are thinking about investing in carefully.

Along with data aggregators, there are various tools that can help you to investigate cryptos. Some are even focused on helping you to figure out whether they are active and valid versus some sort of a scam.

Crypto Investing Research Checklist

Now that you know where you can look up information on the various cryptos you can invest in, you are ready to find out what you should be assessing to determine whether a coin is a worthy investment or not. Keep in mind that while you need to research to give yourself the best chance of profiting, there are no guarantees. Investing in crypto is a high-risk activity, so only invest money you can afford to lose.

Assess How The Crypto Has Been Doing Recently And Historically

One way to start is to take a look at the charts for the coin you are interested in. How has it been performing over the past days, weeks and months? What about since its creation?

Keep in mind that past performance does not guarantee future results. Some coins may moon for a while, and then tank and never come back fully or at all. Still, a history of good performance is better to see than a history of poor performance.

If you are going to do any price action, this is also your opportunity! Price action actually tends to work better on longer timeframes than it does on super short ones, so it may be helpful even for a scenario where you plan to HODL.

As a simple example, maybe you have been seeing a coin following a pattern of increasing consolidation over the past few weeks. A breakout with a significant move may be imminent. That move could be fast or slow. If the crypto does not show a ton of volatility, a slow, long-term move is probably more likely.

- Key Point:

Good past performance does not guarantee good future performance, but it is a good sign.

Consider The Current Price

One of the most important points, always, always take the current price into consideration!

Of course, you are going to want to consider the price that a crypto is at when you buy. But do not make the newbie mistake of only considering the price!

Be aware that timing the markets is really hard. You might be waiting around for the price to drop, only to find it keeps rising. Or you might feel you have spotted a good deal, and maybe it is, with respect to where price has been recently. But when you compare it to where price was half a year ago, a different picture might emerge.

When your goal is to buy and HODL, if you feel the current price is acceptable and your analysis suggests that it will rise over the long term, you may want to just go ahead and buy.

- Key Point:

If you can, try and purchase a coin when the price is favorable, but be aware that timing this can be challenging (and sometimes impossible).

Check The Overall Volatility

While you are looking at price charts for the crypto, take a look at how volatile it has been overall over the timeframe that is relevant to you.

If you plan to hold the crypto for years, for instance, you should look at charts that show you how the coin has performed over a similar span of time or longer (longer is best, if the coin has been around for long enough to chart).

Most cryptos are going to show a higher degree of volatility than a lot of other assets, so you should expect that. But you can assess the volatility of the coin you are interested in relative to other cryptos.

Are the whipsaws particularly bad? Do they look bad enough to stop you out of your position?

- Key Point:

Extreme volatility can be dangerous for holding a position, even a long-term one. Be wary of cryptos that show a lot of crazy whipsaws.

Find Out Whether The Supply Is Limited

Now you are going to move away from the charts for a bit and start learning more about how the coin works.

The first thing you are going to check out is the supply. Ask these questions:

- Is the supply of this coin infinite, or is it capped at a certain set amount?

- If the supply of the coin is limited, what percentage of the coins have been mined?

The reason answering these questions is important is the basic law of supply and demand. A variety of factors can influence demand for a coin, but when supply is limited, that can help to keep demand up.

That said, demand for a supply-limited coin can still drop if it isn’t useful (see below).

- Key Point:

All things being equal, a coin with a limited supply may show higher demand than one with infinite supply.

Look Up The Utility And Purpose Of The Coin

People create cryptocurrencies for a wide variety of reasons. But in general, cryptos can be separated into two piles:

Serious cryptos are designed to solve problems and offer utility. They each have a specific practical purpose.

Coins that are not created with specific real-world applications in mind are known as “meme coins”.

There is sometimes money to be made in meme coins, but it is pretty hard to figure out which meme coins may moon and which may tank. They tend to surge in value as a result of fairly arbitrary events, like a celebrity tweeting about them.

So, we will assume that as a serious investor, you are looking for opportunities that are more likely to pay off.

Read the white paper and other documents and pages provided by the coin’s creators to find out what real-world utility their coin offers. Some questions to ask include:

- What problems is this coin supposed to solve?

- How important is it to solve these problems? What impacts will it have?

- Are the technical aspects of how the coin works viable? How likely is it to be able to deliver on its promises?

You will need to read carefully, and probably a few times over to really understand the coin’s utility and viability. Asking questions of the community may also be necessary if you are having a hard time interpreting what you are reading.

- Key Point:

The best cryptos to invest in are typically those with utility, not meme coins (though meme coins may sometimes do well). Reading the white paper for a crypto project can help you understand a coin’s intended utility.

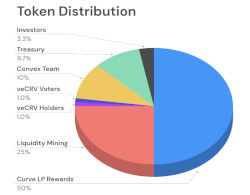

Investigate The Tokenomics At Work

While tokenomics can be very technical, this actually gets more fun the more you get into it!

As you are learning about a coin’s utility, you will also be investigating its tokenomics. Just as you would guess, this word refers to the economics of a token (or coin).

Token supply is part of tokenomics. So is utility. Other aspects include:

- Distribution of tokens or coins

- Burning of tokens or coins

- Incentives offered to ensure participation

- How the coin stays liquid

These subjects can get to be extremely technical. Novice investors in particular may struggle to follow what they are reading in the white papers for coins or tokens that interest them. Again, if you need help, you can ask members of the coin’s community.

- Key Point:

You should read the white paper to understand a coin’s tokenomics as well. They must be viable for the coin to have a chance to succeed.

Take A Look At The Timeline

As you are reading the white paper for a coin, you will be able to find out the intended timeline for the project.

Ensure that the timeline is realistic, and that it gels well with your investing plan.

- Key Point:

A crypto project needs to have a realistic timeline to be a good investment.

Make Sure The Coin And Community Are Active

By now, you should have a good idea as to whether a particular coin or token is sound in theory. It is time to move on to the next stage of your investigation, which is to make a determination regarding the coin’s legitimacy.

If you are thinking about investing in a major crypto like BTC or ETH, you do not need to worry about this. But for a crypto that is not very well known, you need to make sure you are dealing with a team that is both competent and honest.

One way to start is to find out whether there is a healthy, active community surrounding the crypto. Check:

In particular, look for activity from developers, not just passionate enthusiasts. Remember, enthusiasts are a dime a dozen, even for coins that will not take off. Not only that, but sometimes you will see excessive levels of hype in communities for scam coins. But developers are involved in serious work, and if you can transparently see some of that work taking place, that is generally a good indication that at least the coin is legitimate.

You can also look on exchanges or use tools to determine whether the trading volume for the coin is healthy. Lots of activity is generally a favorable sign.

Going back to hype on social media for a coin, you can try to figure out whether that hype is innocent or not.

There are always going to be comments from real people who are over-the-top about coins they are obsessed with for whatever reason. A lot of crypto investors are not very realistic, and think everything they are interested in is going to moon.

These types of comments are not realistic or helpful, but neither are they malicious in intent, but if you consistently see people on social media urging you to buy whatever coin or token RIGHT NOW for GUARANTEED RETURNS or so forth, you might be looking at a scam. The more repetitive the phrasing, the more likely this is to be the case.

- Key Point:

An inactive community for a coin does not bode well. An active community may bode well, especially if you see activity from developers.

Assess The Team

Now that you have had an opportunity to look into the coin’s community, you are going want to learn more about the team behind the project.

Ask these questions as you conduct your research:

- Is the team anonymous, or can you find their names?

- What level of experience and expertise do each of the team members have?

- How large or small is the team?

- Who is partnering with the team, if anyone?

- Who has invested heavily into the crypto?

Go further than just reading the team member bios on the official site for the project. Dig into their social media profiles to learn more about them, and see if any of them have made news headlines.

The more reputable and experienced the team working on a project is, the better. That does not necessarily mean you should never invest in a coin being developed by anonymous or lesser-known people—just know that if you do, you may be taking a larger risk.

- Key Point:

Evaluate the team that is working on a crypto project as best you can before deciding to invest. You can proceed with more confidence if they are well-known and have the right experience to make the project work.

Figure Out If The Team Is Being Transparent

If this looks like any member of the team you probably don’t want to give them any of your money!

Something else you can gauge while you are doing all this research is the level of transparency around a crypto project.

In fact, you will probably be able to assess this without really thinking about it. If trying to find info about how the coin works, its timeline, the team and so forth is a frustrating endeavor, then transparency is low. If coming by the information you need is easy, then the project is more transparent.

Another aspect of transparency is interaction. Do the project leaders make themselves available to community members with questions, or do they hide away where no one can reach them?

If a project has really low transparency, there is a possibility that the team working on it has something to hide. They may dodge questions and hide information because they are running a scam.

But if a project has high transparency, there is a greater degree of trust, and you can more easily see what is going on.

- Key Point:

Look for a high degree of transparency in the crypto projects you decide to invest in.

Find Out Who Makes Decisions About The Coin

Another thing to keep in mind about crypto projects is that they are constantly evolving. While a project may have a particular direction now, who makes the decisions that will shape that project months or years from now?

You should find the answer to this question while you are learning about the tokenomics of the crypto you are thinking of investing in.

Find out who has the right to vote, and how one gains the ability to participate in governing the network’s development.

Consider the governance of a coin in conjunction with the rest of its tokenomics to determine whether it is likely to be a profitable and constructive model.

While you are at it, you may want to see if investing in the coin will give you votes in governing it. This is not a must for investing in a coin, but it is a nice incentive.

- Key Point:

It is important to know how a coin you are thinking of investing in is governed.

Put The Coin In Context Of Its Competitors

Never forget that there are so, so many competitors to everyone’s favorite, Bitcoin.

It is important to remember that any crypto, no matter how potentially useful it might be, does not exist in a vacuum.

Again, there are nearly 23,000 cryptocurrencies out there right now. That means that whatever the purpose of a particular coin might be, there are other coins out there right now that are competing to fill the same purpose. Some might even be using the same approach. That is likely the case no matter how novel any given coin is.

If a competing coin gains a lot of traction, it could result in the coin in which you are thinking of investing struggling or failing, even if its concept is promising.

So, do some research into other coins that are similar to the one you are interested in. Try and compare the advantages and drawbacks to see if you can make a determination over which coins are likeliest to succeed.

If the coin you are considering still looks like it will come out ahead, then it may be a good investment.

- Key Point:

Every coin has competition, so research the competitors before you dive into a new investment.

Make Sure The Sources You Are Using Are Legit

Finally, one more thing to evaluate when you are researching a coin is the resources you are using.

Official documents like a coin’s white paper are only going to be as legitimate as the project and team themselves, so that is one thing to consider.

Naturally, you will get biased information from the project’s site, even if the project is legit. So, you are going to also want to research through third parties.

But third parties can also be heavily biased at times. That means you should filter out information that comes from sources that are unrealistically exuberant in their assessments.

Think of it the same way you would reading product reviews. You expect to see both pros and cons, right? That is what you should be looking for when you are reading posts about the coin, even if they are favorable ones.

As for social media sources, try and find out who is sharing information and opinions on the coin. What is their involvement with the project? How might it be biasing them in their statements? Do not just look at what they say, evaluate them as sources before taking their comments seriously.

- Key Point:

Sources for crypto research vary in terms of quality. Whenever possible, try to get a balanced viewpoint on a crypto you are thinking of investing in that includes both pros and cons.

Summary

Diving headfirst into a crypto investment is usually not a good idea owing to the high risk associated with cryptocurrencies.

But if you do your homework, you can reduce a bit of your risk and give yourself a better chance at making profitable investments.

By following the recommendations above, you can make sure a coin’s fundamentals are strong before you buy.

Frequently Asked Questions

What’s that old commercial? “You’ve got questions, we’ve got answers“!

To wrap up our guide, let’s answer a few frequently asked questions about investing in cryptos.

- Q: Are cryptos a good investment?

A: Sometimes cryptos are good investments, and other times they are not. With their extreme volatility and experimental nature, they are highly speculative assets. So, you should only invest in cryptos if you acknowledge the risk.

- Q: Which crypto is best to invest?

A: There is no single answer to this question; it all depends on what is going on with the various coins and tokens at the time that you are asking it.

The best crypto to invest in today may not be the best one to invest in next week or next month or next year. A lot depends on how long you plan to hold it for as well. You just will need to do your own in-depth research to come to a decision.

- Q: Can you invest $100 in crypto?

A: You can indeed invest $100 in crypto, or any other amount you have available. Crypto can be a suitable investment for someone with $10 or $100,000 or $1 million or a smaller or larger amount.

The most important thing is just to only invest money you can afford to lose since crypto investments are high-risk. If you can afford to lose $100, then by all means, feel free to invest $100 and hope for the best outcome.

- Q: How should a beginner invest in crypto?

A: As a novice crypto investor, you should begin by joining an exchange and getting a wallet. Then, you will need to research coins to decide what to purchase (you can use this guide to walk you through the steps). After you choose a crypto, then you just need to buy some.

It will take some time to learn all the crypto jargon and understand tokenomics, but you will probably enjoy it. Crypto and decentralized finance are fascinating, and before long, you will likely consider yourself a crypto enthusiast.

And You May Be Interested In These Pages As Well