How to Handle Volatility With Crypto

For a lot of people, volatility is part of the appeal of crypto. These days, everyone is hoping that they will be the ones to profit from the next huge upswing in the price of some obscure coin, raking in hundreds of thousands of dollars worth of profit overnight, but volatility is a double-edged sword, and it is one that can cut your funds to pieces just as fast.

So, it is important to know how to avoid volatility too, especially if you are not buying crypto as part of a get-rich-scheme.

Maybe you are just using crypto as a means of sending and receiving payments, or perhaps you are investing in it to build wealth, but you are relying on a gradual, low-risk strategy.

In both cases, huge spikes and drops in your funds are not going to be welcome.

So, what can you do about crypto volatility? Below, we offer some suggestions for how you can minimize your exposure to it when possible. We also offer some tips for how you can handle dealing with it in situations where it is unavoidable.

There are currently over 6,000 cryptos out there. There’s a pretty solid chance you won’t own some of all of them!

Make Use of Stablecoins.

Want to keep your volatility exposure as low as possible? One thing you can do is use stablecoins instead of regular cryptocurrencies.

A stablecoin is simply a crypto that is “pegged” to another type of asset.

That asset could be a fiat currency, for example, or a commodity.

The first stablecoin to be made was Tether (USDT), back in 2014 (there are issues with Tether—but that is another story). As you would guess, the value of USDT is pegged to the US Dollar.

Another example is USDC, which is also pegged to the US Dollar.

So, the values of these stablecoins follow the value of the US Dollar closely. That means that they do not fluctuate up and down as dramatically against USD as, say, Bitcoin (BTC).

In a way, stablecoins are a “best of both worlds” type of crypto. They give you the same freedom that other cryptos do. You do not need to go through a bank to transfer them. But they are less volatile than other cryptos.

So, if someone sends you BTC or another volatile crypto, and you do not want to be exposed to the extreme fluctuations in value that holding that crypto would involve, you can just convert it straight away to stablecoins.

Now, are stablecoins perfect? No, (see below).

Key Point:

Stablecoins offer the benefits of crypto, but are less volatile on the whole than their regular crypto counterparts. Keeping your money in stablecoin form might help you to avoid unwanted spikes and drops in value.

Look for Stablecoins That are Actually Stable.

Although stablecoins are more stable than many other types of cryptos, that does not mean that they are totally devoid of volatility.

Financial services provider INVAO Group explains, “First of all, they are only as stable as their underlying asset – and both currencies and precious metals can fluctuate in value, real estate even more so. Additionally, the values of stablecoins frequently deviate from their underlying assets, mostly due to changing trading volumes.”

After sharing some data, INVAO continues, “The data show that Tether remained relatively stable during 2018. BitUSD, on the other hand, had a much higher standard deviation of 2.5%. The bottom-line: Stablecoins are actually not that stable either. However, they are much more stable than decentralized cryptocurrencies. In the case of Bitcoin, for example, changes in price of more than 20% within a single trading day have happened.”

INVAO then goes on to point out that out of 24 failed stablecoins, 16 were pegged to gold.

One of the reasons for all those failures is that gold is a lot more volatile than a lot of people realize. Another reason has to do with the role of gold custody.

So, if you are trying to avoid volatility by investing in stablecoins, it is probably to your advantage to avoid those that are pegged to gold, and steer towards those that are pegged to relatively stable Fiat currencies.

Now, as INVAO mentioned, there are also variations in how closely various stablecoins follow the same asset.

Some are able to maintain a tighter peg than others owing to various technical differences in how they work. So, instead of just using the first stablecoin you hear about, you might want to conduct some research into the different options that are out there.

Try to choose a stablecoin that has a tight peg to a reliable, stable asset.

Key Point:

Not all stablecoins are equally stable. To minimize volatility, look for those that have a tight peg to a stable asset.

Do Not Make Crypto Your Only Investment Vehicle.

If you’re older than 35, you already know who can’t f*** with.

Crypto is the investment vehicle du jour right now – everybody wants in. But that does not mean that you should necessarily make it your sole investment.

A diversified portfolio is one that can help keep risk in check. Consider balancing out some of your volatile crypto investments with some low-risk investments in other markets. That way, if something goes wrong with your crypto investments, at least you will have those other investments hopefully still holding or maintaining value.

Key Point:

Along with cryptos, you can invest in less risky asset classes to try and balance out your portfolio in the face of volatility.

Diversity Your Crypto Holdings.

Not only can you look to maintain diversity in your portfolio between types of assets (i.e. investing in stocks, commodities, or fiat currencies alongside cryptos), but you can also diversify within a single asset class.

Did you know there are literally thousands of cryptocurrencies out there? Instead of keeping all of your funds as one type of crypto, consider investing in multiple cryptos. If one of them does poorly, perhaps another will offset your losses by doing well!

Key Point:

Diversifying your crypto holdings may help you to weather some of the volatility swings in individual cryptos.

Maybe you’ve already got some and you’d like to borrow some more! If so, make sure to read our Crypto Borrowing 101 article as well!

If You Are Not Investing in Crypto, Convert Crypto Funds to Your Fiat Currency Right Away.

Are you using crypto up to send and receive payments, rather than for investment purposes? If so, you might have no interest in holding something so volatile at all.

The good news is that you do not have to. Immediately after receiving crypto funds to your wallet, you can sell them on an exchange for your fiat currency.

If you take care of this within a matter of minutes, in most cases, you are not going to have to worry about the possibility of losing a lot of value.

Whatever you do, just do not forget that you have crypto funds and then fail to convert them before a major price drop. If you do, you will either need to wait and hope that your crypto rebounds, or you will have to take a loss when you convert to your native currency.

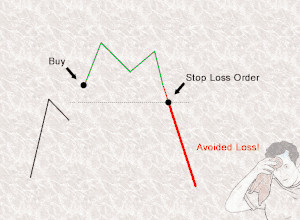

Set Stop Losses and Take Profits When Trading.

Learn about stop-loss and you can save a ton of heartbreak!

If you are in the investment game, you may be actively trading cryptocurrencies in the hopes of making money off of relative changes in value.

One way you can protect yourself from volatile swings in price is to set a stop loss and a take profit each times you enter a trade.

This is most important if you are not going to be able to keep an eye on your trade throughout the day. If price takes a nosedive against your position, the stop loss will get you out before you have lost more money than you are comfortable with.

The take profit will also get you out of a trade. Its purpose is to do so before a winning situation reverses.

One thing to be aware of is that if you do not set your stop loss strategically, it could end up stopping you out of a trade that would ultimately have gone according to your plans. This can happen on retracements. There are various techniques you can use to try and prevent this from occurring, but they are outside the scope of this post.

Key Point:

If you set stop losses and take profits when you are placing crypto trades, you can protect yourself from significant volatility spikes. You can still lose money, but at least you will place a limit on how much you can lose during a single trade.

Consider Hedging.

Just as you can hedge in traditional markets, you can also try hedging to offset the risk of some of your crypto positions.

Indeed, diversifying your crypto portfolio is one strategy you can use to do this.

Futures and other derivatives are also popular assets to use in hedging strategies.

Key Point:

There are many hedging strategies you can use to try and offset the risk of holding a volatile crypto.

If You Are Holding a Volatile Crypto, Try Not to Check on it Constantly.

So far, we have mostly talked about what you can do to try and mitigate your risk when you are dealing with cryptocurrencies. But it could be that you are not trying to actively avoid or minimize your risk, and instead are embracing crypto volatility.

If that is the case, one of the challenges you will need to contend with is psychological in nature. Although some people thrive on the ups and downs, for many, the rollercoaster ride that is crypto volatility is hard to handle. So, one word of advice is to avoid constantly checking on the price of your crypto. This could be quite difficult to train yourself to do, depending on how strong your compulsion is.

But staring at the screen or loading it up to every five minutes is not going to help. The big jump in value you are waiting for is not going to happen any faster just because you keep staring. Likewise, the recovery you are hoping for after a sudden drop is also not going to come any more quickly just because you keep checking.

It may drive you crazy not to check—but checking all the time will probably just drive you crazier.

Plus, it will end up devouring a lot of time and energy you could be spending on other things.

Also, the more compulsive you are about checking, the more impulsive you are likely to be about buying and selling.

You do not want to be making emotional decisions in any market, including a volatile one.

Key Point:

It may be hard not to constantly check on the price of a volatile crypto you are holding, but doing so is not going to help its price climb, nor will it stabilize your mood.

Be Aware That Holding Cryptos Does Tend to Require the Ability to Weather Regular Significant Drawdown.

Do you really need to HODL them bad boys? That’s a tough decision you’re going to come into!

That brings us to the next point. How are you going to react when there is a huge drop in price for a crypto you are holding?

In some case, maybe the right decision is to sell at that point. Sometimes cryptos don’t come back. Not every coin that is here today will be here in one year or ten.

But in a lot of cases, it makes sense to keep holding, because even cryptos that do gain in value over time often have huge price drops along the way.

CNBC reports, “ ‘When people buy and sell in a dizzied cycle, they miss the bigger cryptocurrencies picture and the blockchain technology on which they are traded,’ said financial advisor Ric Edelman, founder and executive chairman of Edelman Financial Services. He said his decision to hold bitcoin for years has paid off. ‘I’ve watched it go from $1 to $1,000, back to $200 and then to $16,000,’ he said.”

If you are cringing at the thought of watching your own $1,000 drop down to $1, you may have a hard time coping with volatile crypto markets.

So, what can you do about it? Well, you have two choices: either avoid holding volatile crypto assets, or find a way to get used to it.

In terms of “getting used to it,” the best thing to have on your side is probably education and a solid strategy for your investments.

Naturally, you will also need to have enough financial stability in your life overall that you can handle drawdown in your account.

If you understand why cryptos rise and fall, and you have a good reason to believe that the one you are investing in will make a comeback after a dramatic drop, it will be a little easier for you to sit with it and wait to see what happens.

Key Point:

Crypto volatility can be anxiety-inducing for a lot of people, who are unprepared to endure large swings up and down. Make sure you are financially stable before you invest in crypto so that you are not bowled over by temporary drawdown. Educate yourself and have a good reason to invest. Doing so will improve your chances and help you stay calm.

Don’t be Tempted by FOMO.

Finally, if you are not afraid of volatility and find the idea magnetic, we do want to caution you.

The volatility of cryptocurrencies can pay off big, but it can also cost you big if you do not know what you are doing.

CNBC says, “Peter Ayton, who studies behavioral decision theory at the City University of London, said it’s hard to expect people to be rational with cryptocurrencies. Many people who’ve been seduced by bitcoin are individuals who might not fully understand what they’re buying, he said.”

Basically, anxiety goes two ways with cryptos. On one hand, there are people who are scared of the ups and downs, and on the other, there are people who are just afraid of missing out. They worry they will miss their chances to get rich while others pass them by.

If you want to hold crypto as an investment, that’s great. Just makes sure you are doing it for the right reasons. FOMO is not a reason to invest in an asset. Irrational financial decisions lead to losses more often than not.

Key Point:

There are a lot of good reasons to invest in volatile cryptocurrencies, but fear of missing out is not among them.

Volatility is Unavoidable With Crypto, But There Are Ways to Deal With It

Ultimately, if you decide to invest in crypto or use it for payments, you are going to be exposed to some degree of volatility.

But now you know that there are ways you can sometimes minimize the volatility to which you are exposed.

You also have some perspective and recommendations for how to handle the large swings up and down that are unavoidable while holding crypto.

Whatever you are using crypto for, good luck. Hopefully volatility will be on your side more often than not. And if you are looking for where you can buy, sell, and exchange cryptocurrencies and stablecoins quickly and easily, take a look at our reviews.

And You May Also Want to Take a Look at These As Well: