DeFi 101: What is Decentralized Finance, and Why Does It Matter?

If there are two words that are thrown around a lot these days in the world of cryptocurrencies, they are “decentralized finance.” More frequently, you will simply read the acronym, “DeFi.”

Not familiar with DeFi, and wondering why it is such a big deal? In this post, we are going to introduce you to the basics of what decentralized finance is, why it is important, what it could mean for you, and how you can get involved.

It may look a bit confusing at first, but read on… It’s really not!

What is Decentralized Finance?

To explain the concept of decentralized finance, we’ll turn to what Kraken has to say.

It would be nice to be able to give one simple, neat definition for DeFi. But as Kraken explains, that may not be the best way to explore the concept.

Kraken writes, “It’s important to acknowledge DeFi is a newer term just now coming into wider use. This means that DeFi, short for decentralized finance, doesn’t have a strict definition. Rather, it is attempting to describe what a certain class of cryptocurrencies is now striving to achieve.”

What goal is that? Taking financial services out of the hands of central entities—or, more accurately, providing customers with an alternative to those traditional centralized platforms.

CNBC writes, “Through DeFi lending, users can lend out cryptocurrency, like a traditional bank does with fiat currency, and earn interest as a lender. Borrowing and lending are among the most common use cases for DeFi applications, but there are many more increasingly complex options too, such as becoming a liquidity provider to a decentralized exchange.”

Back in 2017, DeFi smart contracts collectively were only worth a couple million dollars. Today, they are worth billions.

As we move forward into the future, you can expect this trend to continue. Decentralized finance very much represents the shape of things to come.

- Key Point:

Decentralized finance is exactly what it sounds like—a growing set of products and services that allow for financial transactions that are free from the oversight and control of a single centralized entity like a traditional bank.

Also, make sure you take a look at “Burning Cryptocurrency” and learn why it’s a good thing!

How Does DeFi Work?

Now you understand the basic idea of decentralized finance. But how does it actually work?

Ethereum.org explains, “In DeFi, a smart contract replaces the financial institution in the transaction. A smart contract is a type of Ethereum account that can hold funds and can send/refund them based on certain conditions. No one can alter that smart contract when it’s live – it will always run as programmed.”

The site continues, “A contract that’s designed to hand out an allowance or pocket money could be programmed to send money from Account A to Account B every Friday. And it will only ever do that as long as Account A has the required funds. No one can change the contract and add Account C as a recipient to steal funds.”

So, utilizing smart contracts, it is possible to provide reliable, predictable services that are every bit as trustworthy as those offered by traditional financial institutions.

Indeed, in some respects, we might even say that these services are more trustworthy, since no corrupt company can interfere (see below).

- Key Point:

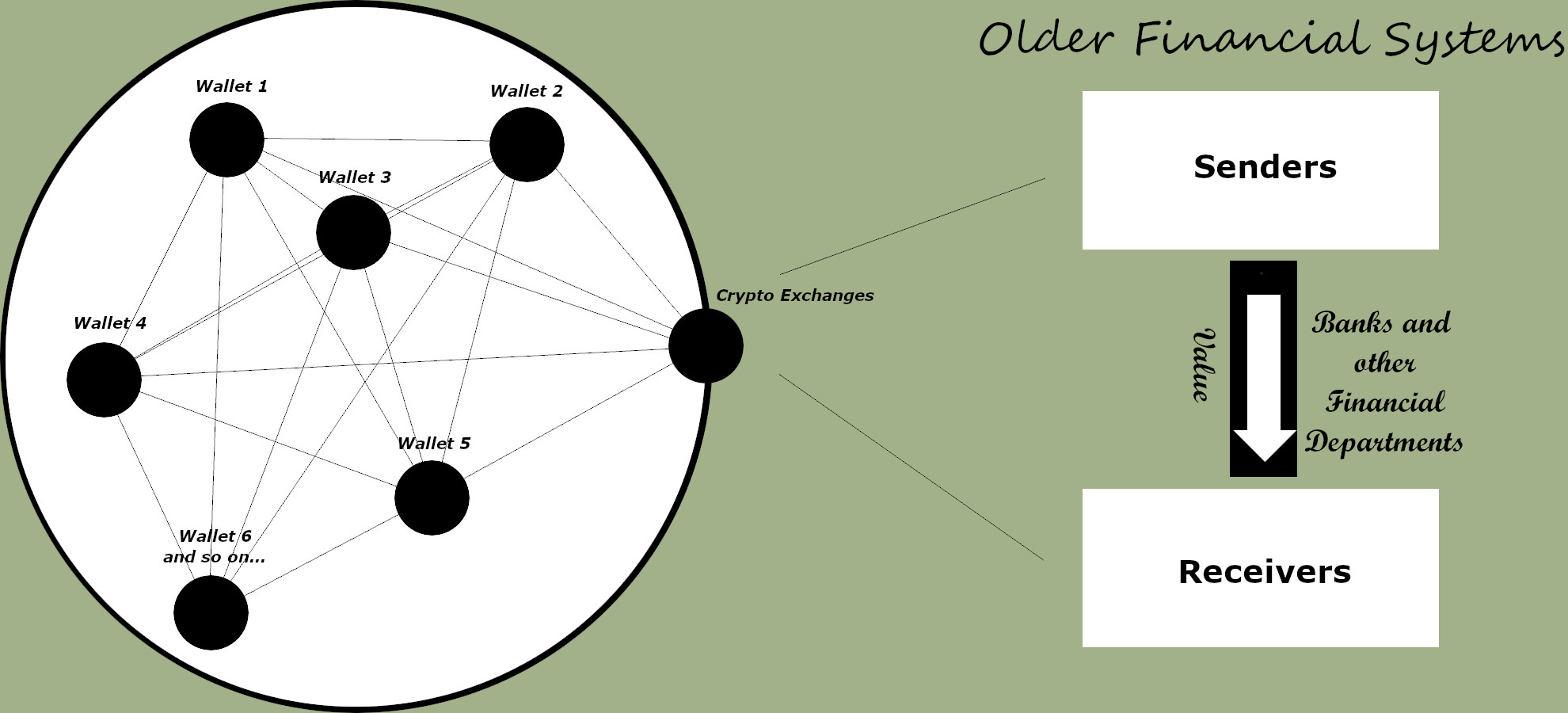

In traditional finance, banks and other centralized entities manage transactions. In DeFi, smart contracts take on that role, eliminating the need for a centralized entity.

How DeFi Could Fit Into a Broader Decentralized Internet

The problem of centralization isn’t one that just affects finances—it is a pervasive one that impacts every area of our lives.

This is a time of monopolies. We purchase the majority of our goods from a few big box stores. We conduct almost all of our searching through just a couple of search engines (and mostly just Google). We conduct our networking online through a few major social networking sites.

Money, information, and power are consolidated into just a few hands.

As a result of centralization in our economies and on the web, we are at the mercy of gatekeepers. Big companies decide what is and is not visible, and who does and does not profit.

These central entities are in a position to exploit us, of which they take full advantage.

Take, for example, the recent controversies that have plagued Facebook (or “Meta,” as the parent company has renamed itself).

For starters, there was the set of reports revealed by whistleblower Frances Haugen, which “revealed that the company knew its products can cause meaningful harm — including negatively impacting the mental health of teens — but it still has not made major changes to fix such problems.”

To top that off, there was a massive outage that affected billions of people. And lest we forget, there was an even longer one a couple years ago.

Each time a major network like this goes down, peoples’ lives grind to a halt. Many people cannot even conduct business effectively without social media.

And let’s talk for a moment about another recent controversy that highlights the dangers of centralization—this time with respect directly to crypto finance.

I am talking about what has been going on with Tether.

The Tether stablecoin (USDT) is not decentralized. And the Tether Holdings Limited has been less than transparent.

Recently, the CFTC investigated the company and lobbed massive fines at it. As explained here, “The order also finds that, instead of holding all USDT token reserves in U.S. dollars as represented, Tether relied upon unregulated entities and certain third-parties to hold funds comprising the reserves; commingled reserve funds with Bitfinex’s operational and customer funds; and held reserves in non-fiat financial products.”

Tether and Bitfinex will need to pay over $42 million in fines.

So, that really puts into perspective what can go wrong with centralized crypto products.

In situations like these, another company is in control of your money and may not even be honest with you about what they are doing with it.

Not only does this increase the overall risk that you are exposed to, but it also is something that is worth fighting on principle.

It is your hard-earned money, and you have a right at all times to know what is happening with it. That way, you can make informed decisions about what you want to do with your crypto.

These are the types of problems that DeFi can help us to solve. DeFi takes control away from corporations, and gives it to the people.

- Key Point:

Centralization has led to widespread problems impacting not just our financial lives, but our lives overall. Decentralized finance puts power back in our hands where it belongs.

What are the Benefits of Decentralized Finance?

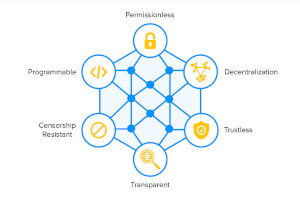

Some of the benefits of DeFi.

Here are just a few of the advantages of using DeFi products and services:

- Tired of the low interest rates offered by traditional financial institutions these days? You can earn interest at a higher rate through a DeFi platform in many cases.

- If you want to borrow money fast and you have crypto to use as collateral, you can usually get a loan in minutes, often with no credit check.

- The overall flexibility of decentralized finance is much higher than that of traditional financial products. Wait times are short or nonexistent for most products, and fees are minimal.

- DeFi offers complete transparency. Because everything is recorded on the public blockchain, know the system is fair and open.

- Everybody can use DeFi products. It is not like when you apply to open a bank account, and the bank can turn you down if it is not satisfied with your financial record or the assets you possess. You just need to have a connection to the internet.

- Because transactions are processed by technology, human error is not an issue. If you are concerned about the quality of the code, you can look over it yourself. It is completely public.

- Your transactions are pseudonymous, allowing you to protect your identity in an era when doing so is more crucial than ever.

- If you want to trade, you can do so anytime from anywhere on any device, so long as you have access to the web. Other markets close during some days and hours, limiting your ability to trade.

- Decentralization is less fragile in comparison to any centralized system. When a system is centralized, the health and good will of the centralized entity are critical for the system to function. If either fail, the system fails. Decentralized systems are not subject to that kind of frailty.

- Key Point:

Higher interest rates, rapid transactions, increased flexibility, unrivaled transparency, and open access are some of the key benefits of decentralized finance.

With DeFi, You Can:

- Get access to financial services without the risk that a broker, bank or credit union is going to deny you.

- Send and receive funds rapidly and affordably.

- Stream payments as your employees earn throughout the workday (or receive your own wages the same way).

- Trade cryptos.

- Store your funds as stablecoins that are pegged to fiat currencies (to avoid volatility spikes).

- Borrow money quickly and easily.

- Build up a portfolio of crypto investments and grow your wealth.

- Purchase insurance that is fair and affordable.

… And more.

The Conversation writes, “DeFi is sometimes known as ‘Lego money’ because you can stack dApps together to maximise your returns. For example, you could buy a stablecoin such as DAI and then lend it on Compound to earn interest, all using your smartphone.”

- Key Point:

DeFi has numerous applications and use cases. You can sometimes stack them together to boost your advantages.

Does DeFi Have Any Drawbacks?

We’ve got to wait and see what people like this think you should be able to do with your money.

While decentralized finance is promising, it is important to understand that there are still drawbacks.

High volatility can be involved with decentralized finance, since you are holding your funds in crypto form. Crypto assets continue to be subject to extreme price fluctuations, and sometimes whole accounts are wiped out in minutes by tremendous drops in asset value.

If you are trading, you could sometimes find yourself dealing with significant slippage owing to the volatility discussed above.

Taxes can be confusing and complicated when you use DeFi products.

We are still waiting to see how regulators around the globe are going to choose to handle decentralized finance. Depending on the decisions they make, we could see things shake up quite a bit in the future!

- Key Point:

While the benefits of decentralized finance are many, there are a few drawbacks as well.

How Can You Take Part in Decentralized Finance?

Now you understand more about the problems involved with our current centralization of the economy, the internet, and financial services.

You also are familiar with the basics of decentralized finance and how DeFi solutions can help empower individuals toward greater financial freedom. But how can you get started with DeFi yourself?

There are a number of possible inroads.

For example, Gemini supports a broad range of DeFi tokens. Some examples include Balancer (BAL), Curve (CRV), Ren Network (REN), Synthetix Network (SNX), Uma (UMA), Uniswap (UNI), and Yearn.finance (YFI).

So, you can buy, sell, or trade DeFi tokens on this platform.

As another example, you can visit Binance if you are interested in participating in DeFi mining projects.

Some of our recommended platforms also incorporate a combination of centralized and decentralized elements.

- Key Point:

There are already many crypto platforms that allow you to participate in DeFi.

The Future of Finance is Here

Even though DeFi has grown by leaps and bounds over the past few years, in many ways, we are still only now just beginning to see the hints of its full potential.

But there is no need to wait. You can experience the advantages of decentralized finance now.

To get started, take a look at our reviews of top crypto platforms. It is time to break free of corporations to embrace true financial freedom.

And You May Also Want to Check Out: